Mortgage Rates: Where are They Headed?

Keeping a close eye on mortgage rates is crucial for those planning to purchase a home in the next 12-24 months. Since mortgage rates directly impact affordability when securing a home loan – an ongoing challenge in today’s market – it is essential to understand the historical context of mortgage rates and where they stand today. Furthermore, gaining insights into their connection with inflation can provide valuable information about potential future trends.

Providing Context for Sticker Shock

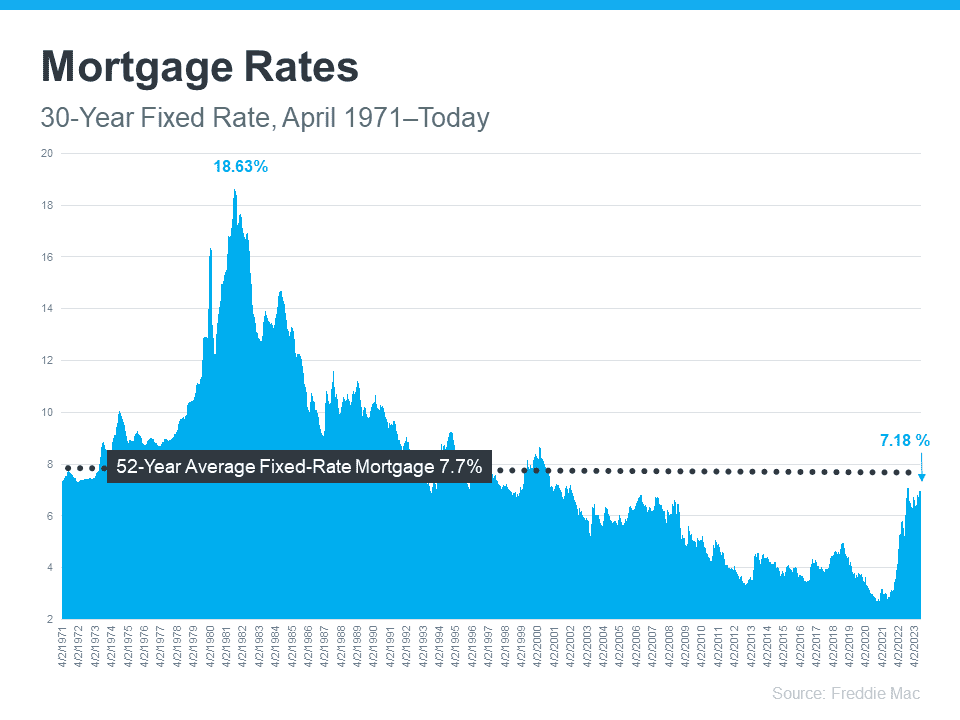

Since April 1971, Freddie Mac has diligently tracked the 30-year fixed mortgage rate. They regularly release the results of their Primary Mortgage Market Survey, which compiles mortgage application data from lenders nationwide (refer to the provided graph for visualization).

Analyzing the graph’s right side, one can observe a significant increase in mortgage rates since the beginning of last year. Despite this rise, however, today’s rates still remain below the 52-year average. While this historical perspective is noteworthy, it is essential to acknowledge that buyers have grown accustomed to mortgage rates ranging from 3% to 5% over the past 15 years.

This information is crucial as it explains why the recent rate hike might seem shocking, even though rates are near their long-term average. While many buyers have adjusted to the elevated rates over the past year, a slightly lower rate would undoubtedly be a welcome change. To determine the likelihood of that possibility, examining the impact of inflation is crucial.

Estimating Future Mortgage Rates

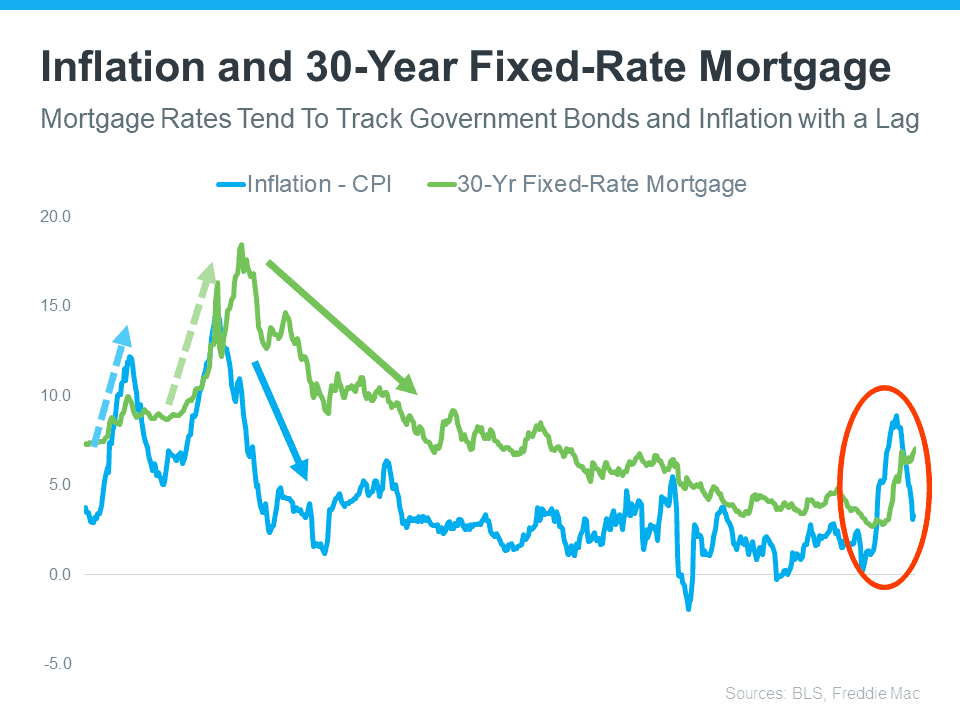

Since early 2022, the Federal Reserve has been actively working to lower inflation. This holds significance because, historically, there has been a reliable correlation between inflation and mortgage rates (as illustrated in the provided graph).

The graph demonstrates a consistent relationship between inflation and mortgage rates. Analyzing the left side of the graph, it is evident that each time there is a significant movement in inflation (blue), mortgage rates tend to follow suit shortly after (green).

The circled portion of the graph highlights the recent surge in inflation, with mortgage rates closely following behind. Although inflation has moderated somewhat this year, mortgage rates have yet to display a similar trend.

Applying historical correlations, it can be suggested that the market is awaiting mortgage rates to align with the trajectory of inflation and eventually decrease. While it is impossible to predict mortgage rates with absolute certainty, the tendency for inflation to moderate indicates a potential downward shift in rates.

Bottom Line

Mortgage rates have an enormous impact on your ability to buy a home. Given our current inflationary environment, higher interest rates will be a fact of life for the next few years. If you’re serious about buying a home, you must assemble a professional team to help you achieve your goal. The first step is to set up a preliminary Buyer Consultation. This no-pressure question-and-answer session will help you clarify your home ownership goals and give you an action plan to purchase a home. To learn more, see What’s a Buyer Consultation & Why Do You Need One?