Understanding Mortgage Rates: Historical Data and Future Predictions for Homebuyers

If you plan to buy a home soon, staying informed about mortgage rates is crucial. Mortgage rates directly impact affordability when taking out a home loan. Given the recent escalation of mortgage rates, it’s helpful to analyze the historical trends and mortgage interest rates to understand their relationship with inflation to make informed home buying decisions.

Understanding the Impact of Mortgage Rates

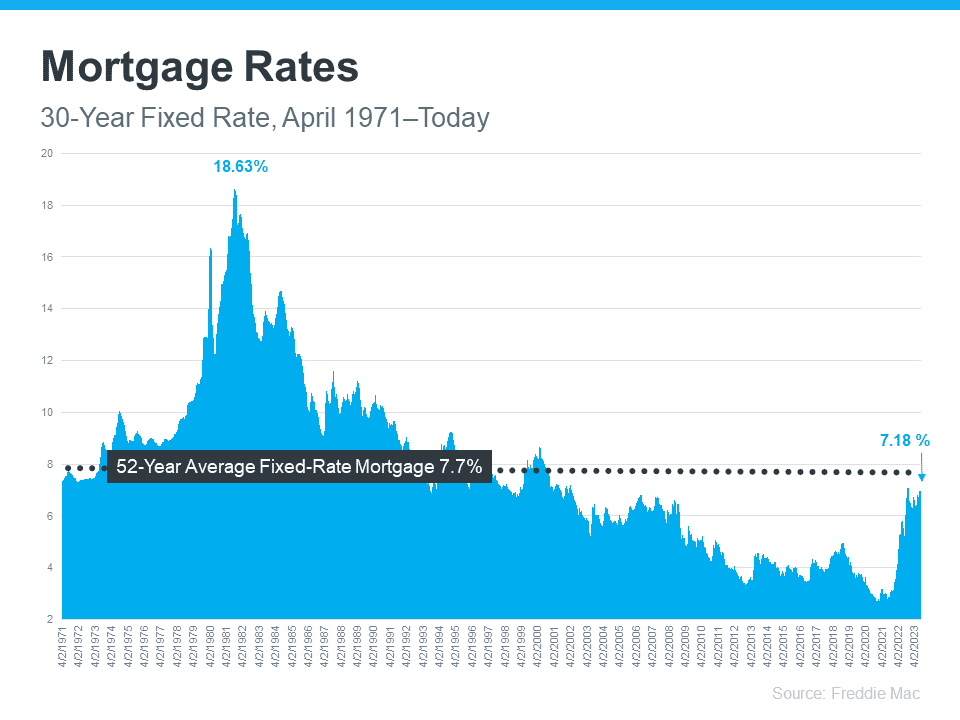

The Freddie Mac Primary Mortgage Market Survey has tracked the 30-year fixed mortgage rate since April 1971. The graph below illustrates the average mortgage application data collected from lenders nationwide:

The graph illustrates the dramatic rise in mortgage rates since the beginning of last year. Many buyers have become accustomed to mortgage rates ranging between 3% and 5%, which we’ve experienced over the past 15 years. These low rates were implemented to offset the negative impact of the crash of 2008 and pandemic years of 2020-2022.

Exploring the Recent Increase and Buyer Reactions

The rapid surge in mortgage rates during the latter half of 2022 slowed the market. Even though many buyers have been squeezed out of the market by the higher rates, today, there are enough buyers who can manage the higher rates, and the market has remained stable.

Analyzing the Connection Between Inflation and Mortgage Rates

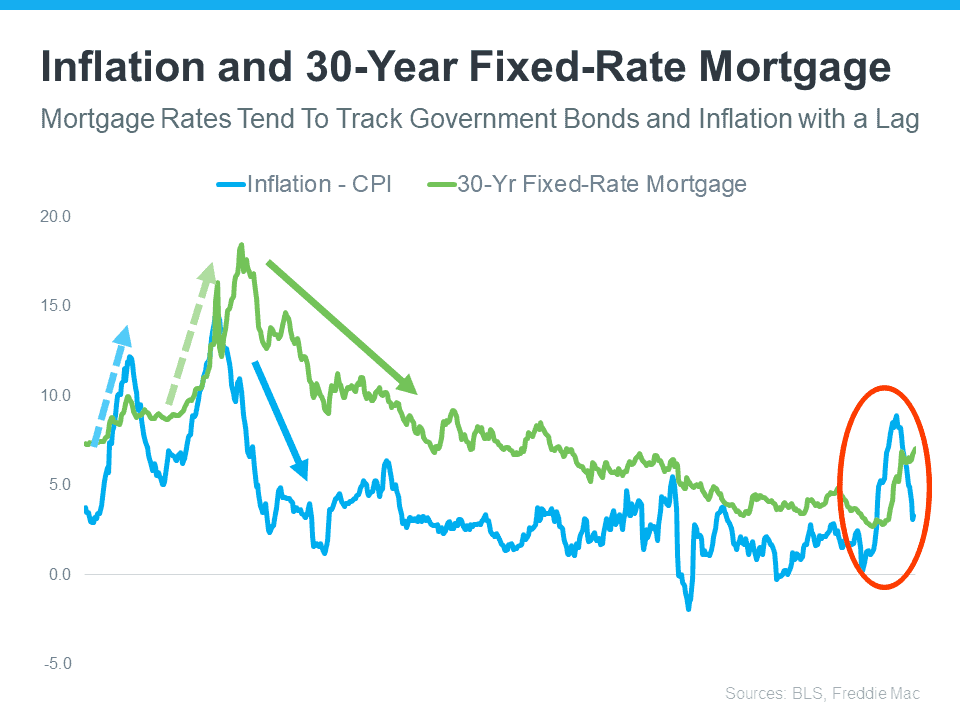

Historically, there has been a noticeable correlation between inflation and mortgage rates, as depicted in the graph below:

The graph clearly demonstrates the strong relationship between inflation and mortgage rates. Whenever there is a significant shift in inflation (shown in blue), mortgage rates tend to follow suit shortly after (shown in green).

The circled section highlights the recent inflation spike, with mortgage rates following closely behind. As inflation has subsided somewhat this year, mortgage rates have yet to make a similar adjustment.

Predicting the Future of Mortgage Rates

Based on historical patterns, experts believe mortgage rates will eventually align with inflation. While it is impossible to predict the exact trajectory of mortgage rates accurately, if inflation continues to moderate, history suggests a decline in mortgage rates will follow.

Being aware of these factors and staying updated on mortgage rate trends will empower you to navigate the market effectively as a homebuyer.

Bottom Line

If you’re considering buying a home in the next 12 months … now is the time to start taking action. When mortgage rates come down – and all the experts say they will – there will be a dramatic increase in buyer demand for homes. Due to a decade of anemic new home construction, the underlying reality of the market is that there are more buyers than homes available for sale. This means that when mortgage rates do come down, we’ll likely see a return to home buyer bidding wars. The solution is to set up a buyer consultation with our team to build a home-buying strategy to position you to buy the home you want when the time is right.